The new paradigm-shifting solution for laytime claims processing

✓ Digitalise and standardise your laytime claims process

✓ Improve accuracy and speed, reduce errors

✓ Faster cash conversion of your claims

Are you experiencing any of these laytime pains?

Financial issues

- Millions of $ locked up on balance sheets

- Unpredictable cash payments

Industry issues

- Multiple claims versions from counterparties

- Many one-off stakeholders

- Laytime talent shortage

Operational issues

- Highly manual, complex, tedious process

- Ambiguities leading to costly disputes

- Data entry errors

Why laytime needs a better solution: Why nobody is happy

Christian (Marcura’s chairman) and Jens (CEO) are the creators of ClaimsHub and have been investigating this problem for years.

Here’s Jens:

![]()

Everybody is frustrated with the claims process. Nobody is happy.

Claims which should, by rights, be settled very quickly, take on average 5 months to settle.

Why?

We have analysed this and realised that even if one party and the other party have great systems and great people, they do not have the same process so there’s no coordination of the process between counterparties.

There are a lot of claims solutions out there in the market today because every team needs to have at least a spreadsheet or a calculator or some other platform that helps them with their claims.

What is actually missing is the platform that coordinates claims between parties in a transparent reliable way.

That’s ClaimsHub.ai.

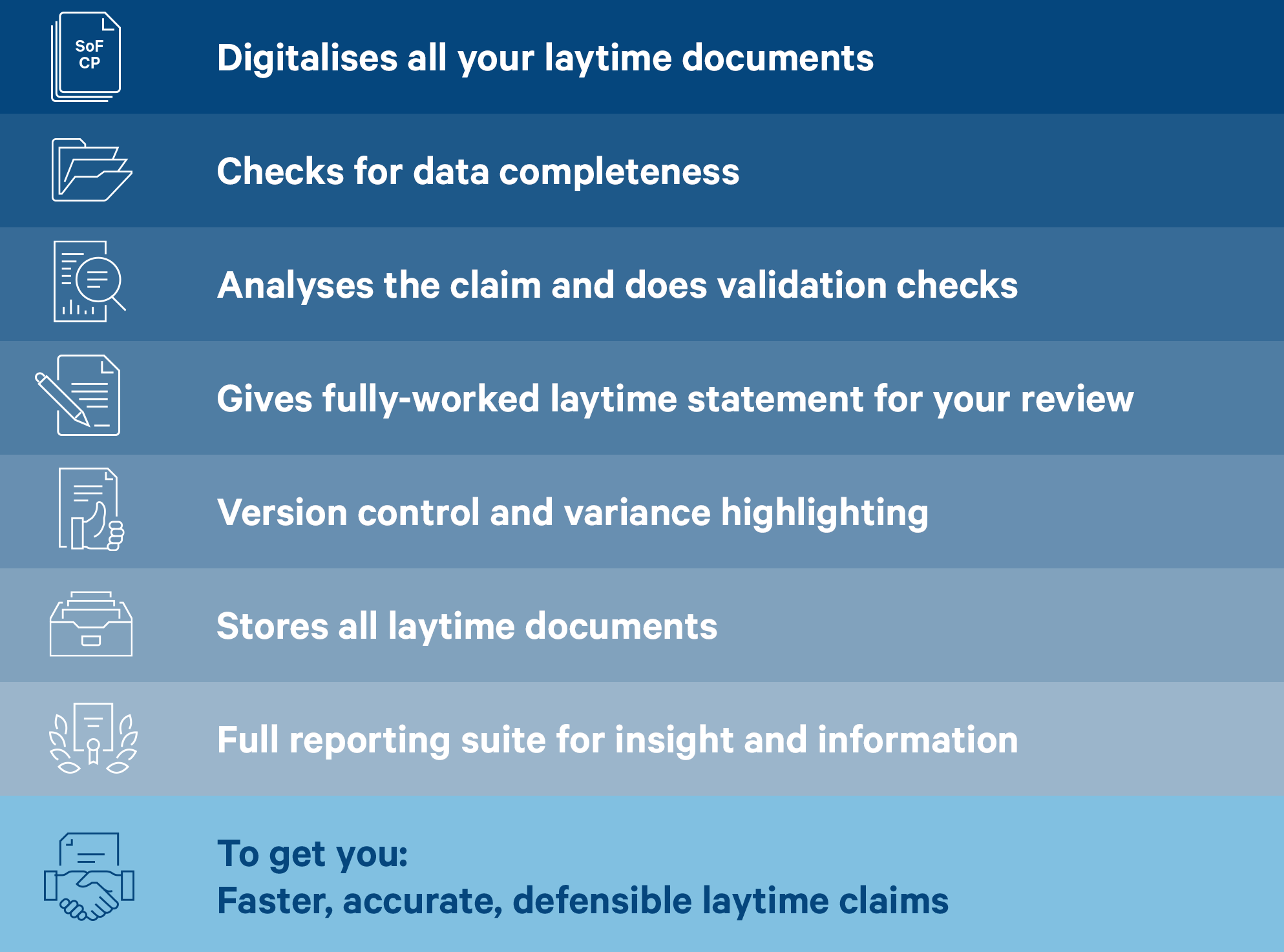

The ClaimsHub platform does all of this

What is ClaimHub?

Here’s Jens again:

![]()

ClaimsHub.ai is a very sophisticated workflow platform that is managed by a dedicated team of claims experts here at Marcura.

Whilst the calculation and documentation are important, the workflow before and after the claim is submitted and contested and agreed is also important as that entire end-to-end workflow needs to be managed.

Since nobody in the industry can control each other’s workflow, there’s a logical need for a third party who can act like an enabler of a streamlined workflow and that requires a platform and people.

So we dedicate a number of claims experts, process experts and data experts to keep the claims flow going so that it doesn’t stop at any time on anybody’s desk.

That will speed up the reporting, analysis, approval and ultimately, the settlement of claims to benefit everybody in the supply chain.

The benefits of having a standardised and enabled process and a platform with lots of data on the process and on the claims will yield a range of benefits for the CFOs and for the users.

Users:

Will have a very efficient platform, very much like having a modern digital back-office.

CFOs and CEOs:

It also benefits the company at large because there’s a counterparty involvement so claims are a service that a shipowner actually delivers to their freight customers.

When you can speed up the process – and our team will make sure that the process is speedy and accurate – that brings you closer to speedier settlement.

A speedier process will lead to faster cash conversion of your claims.

Chartering team:

We can provide analytics of which part of the claim is related to which part of the charter party which then has ambiguity which is either on the charter party itself or on the statement of facts.

So that produces a valuable learning loop.

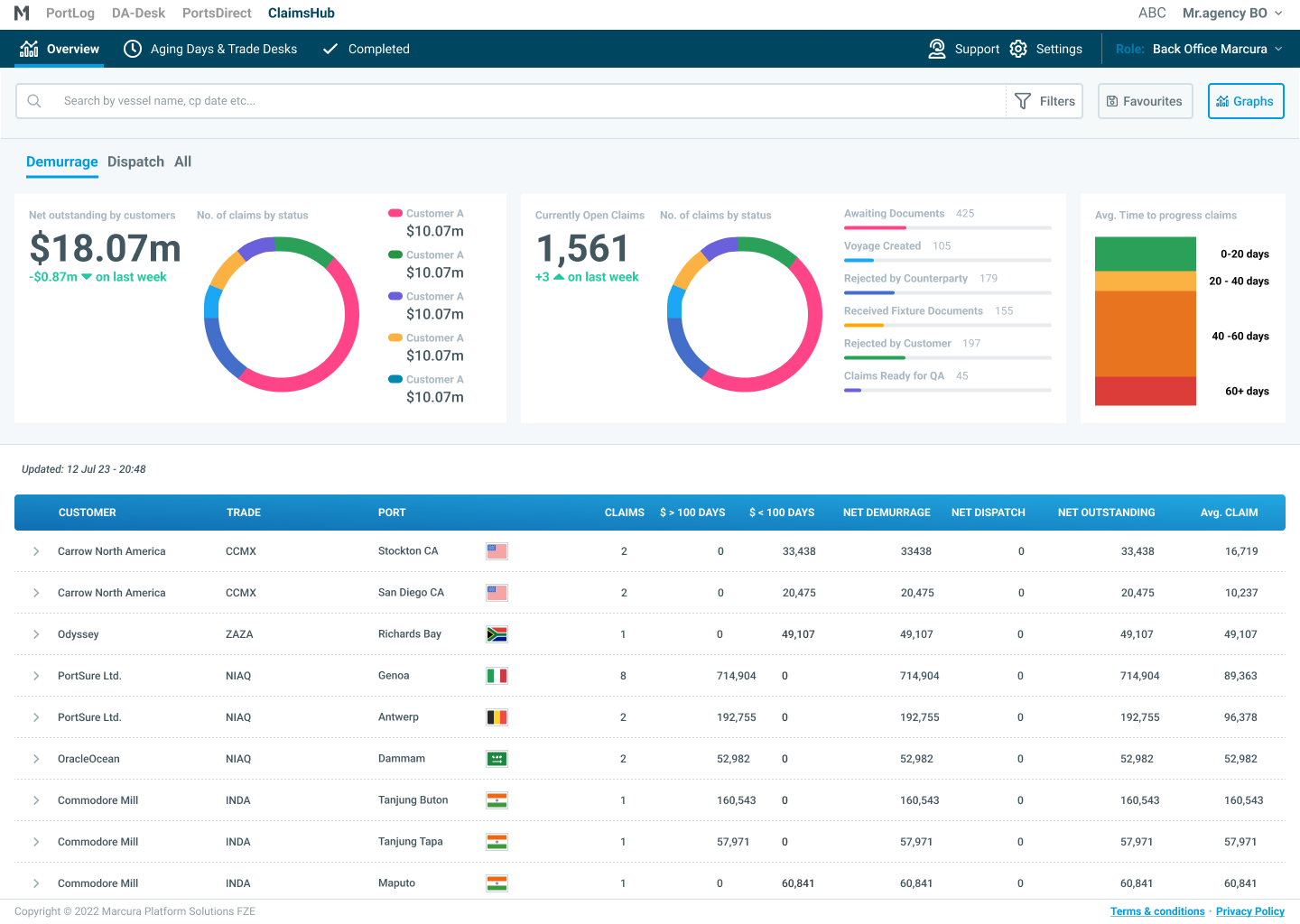

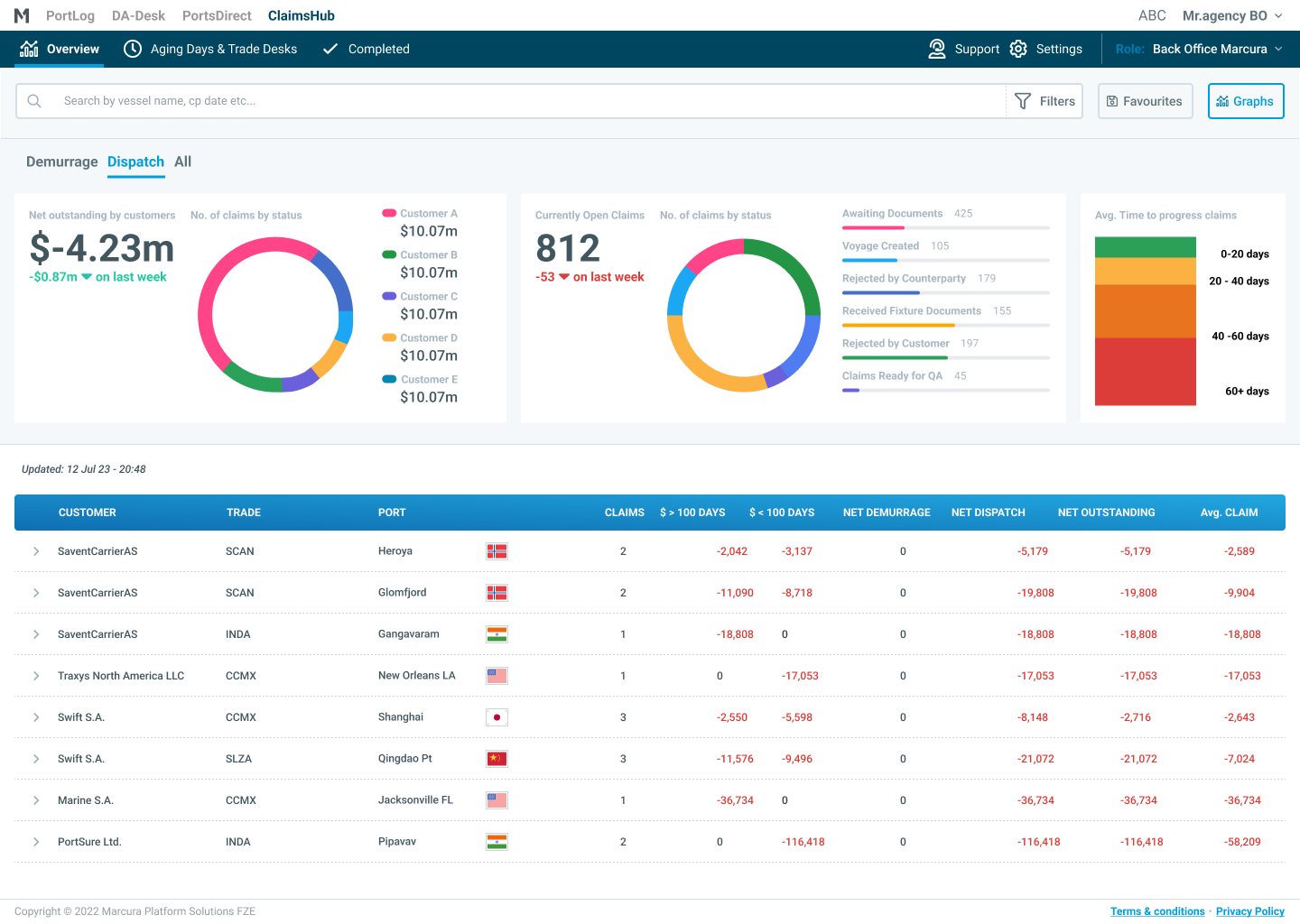

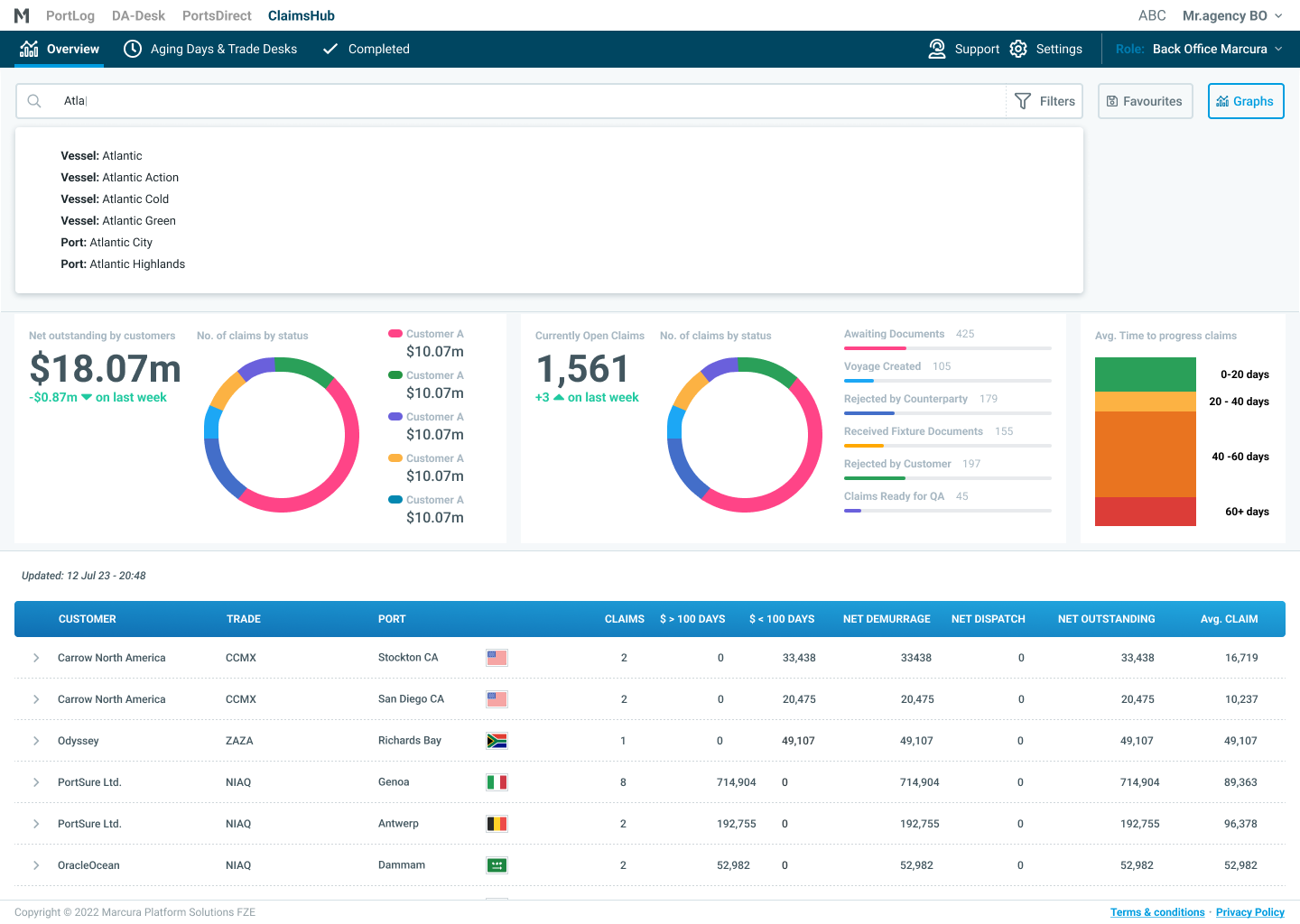

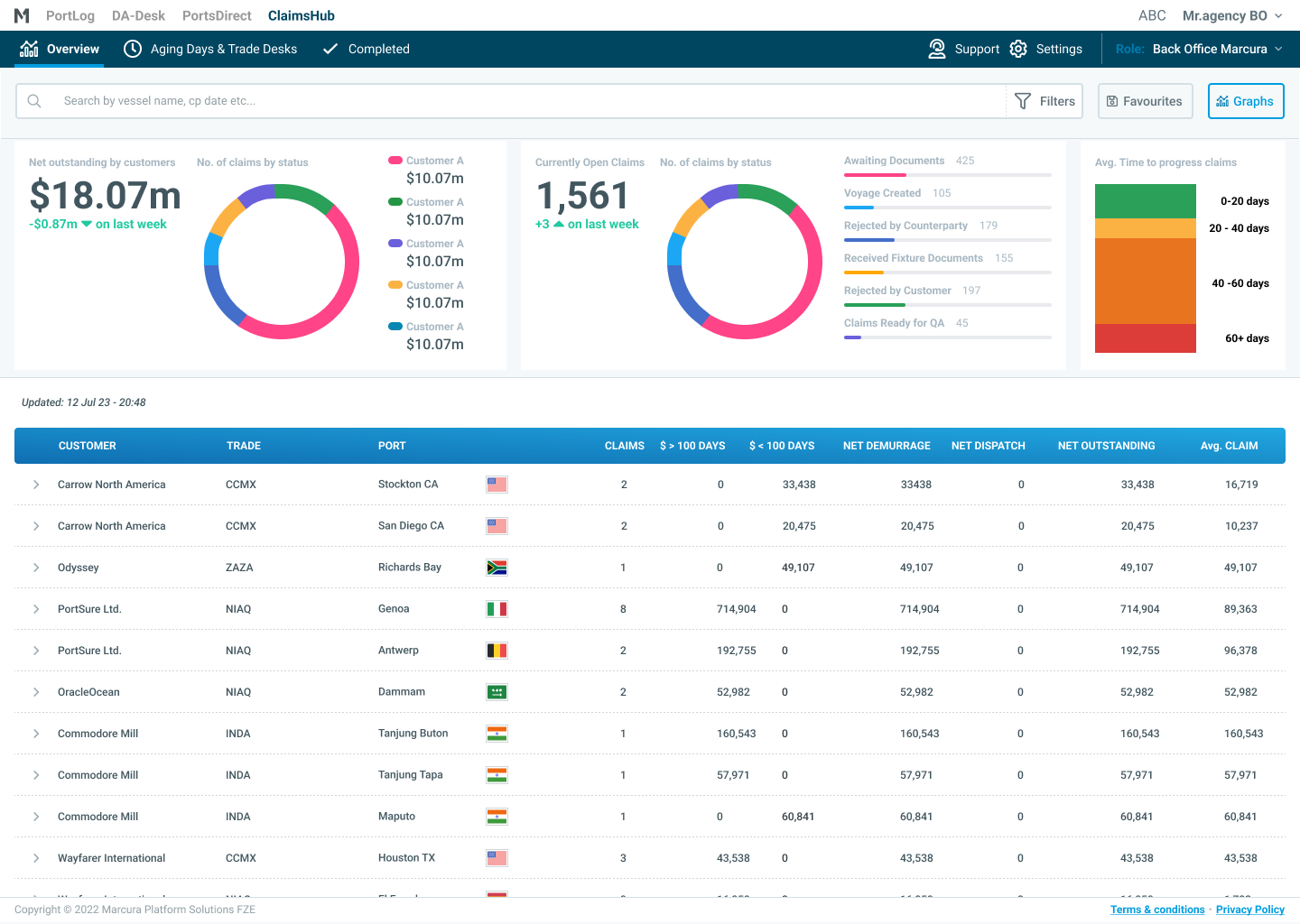

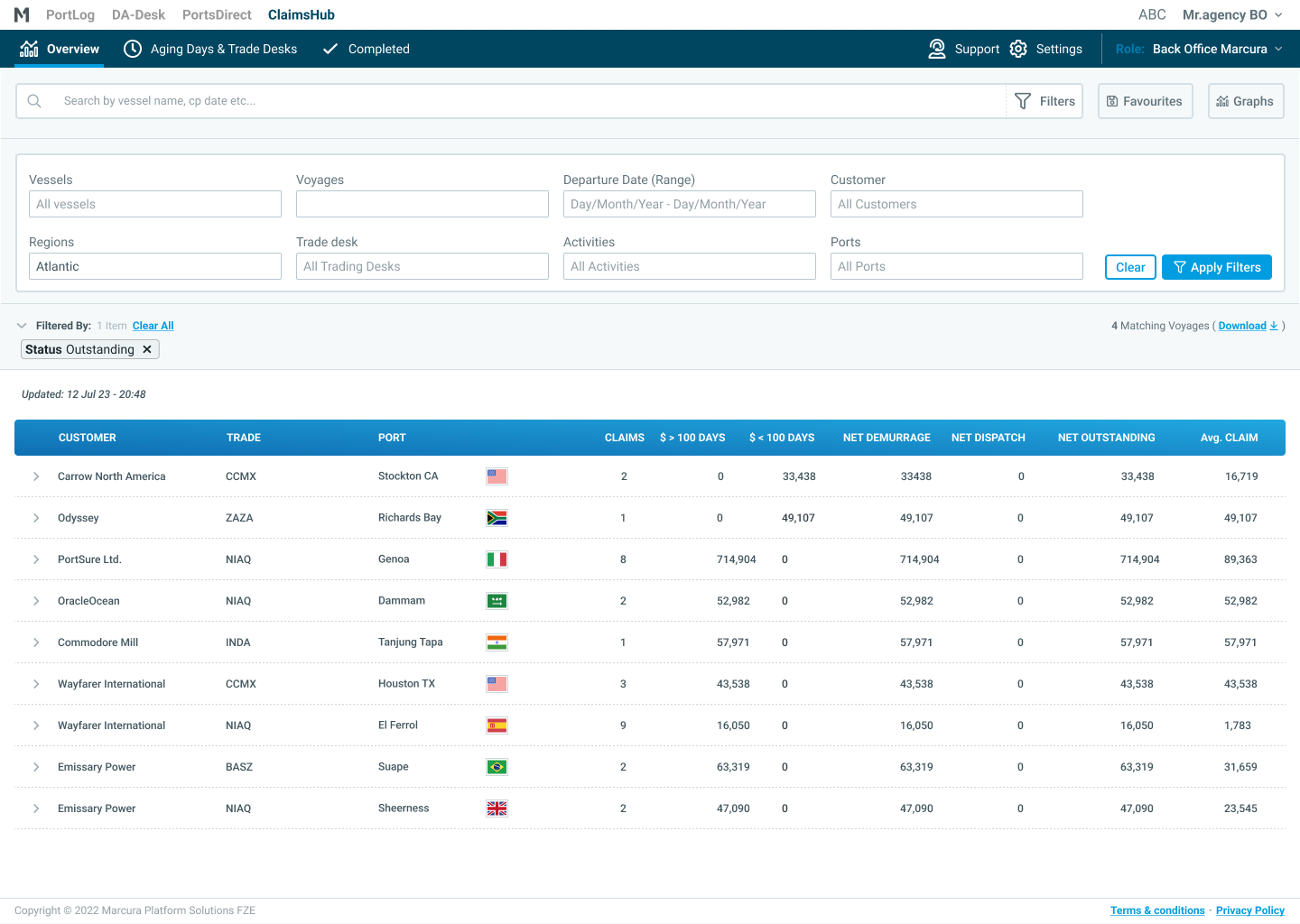

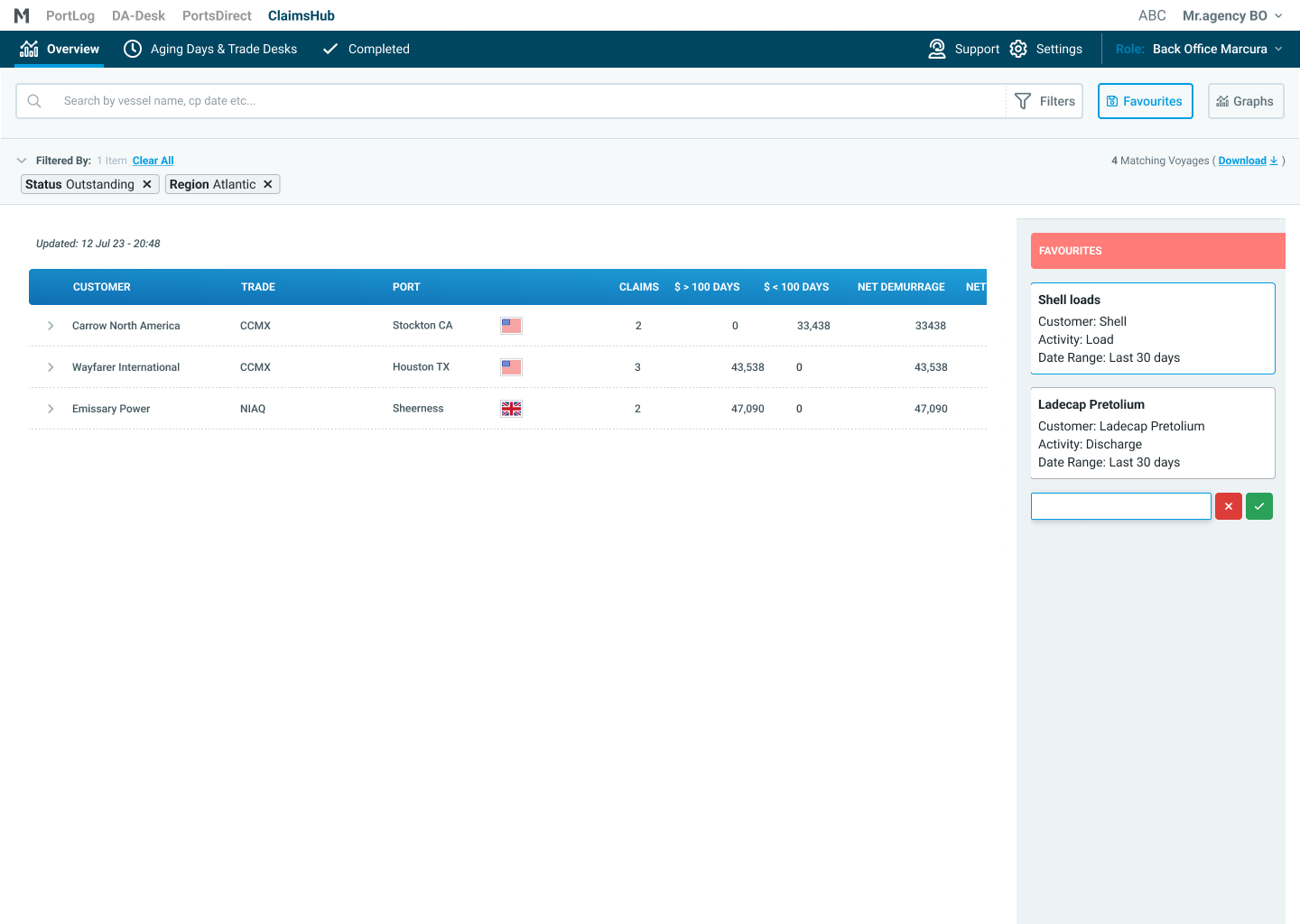

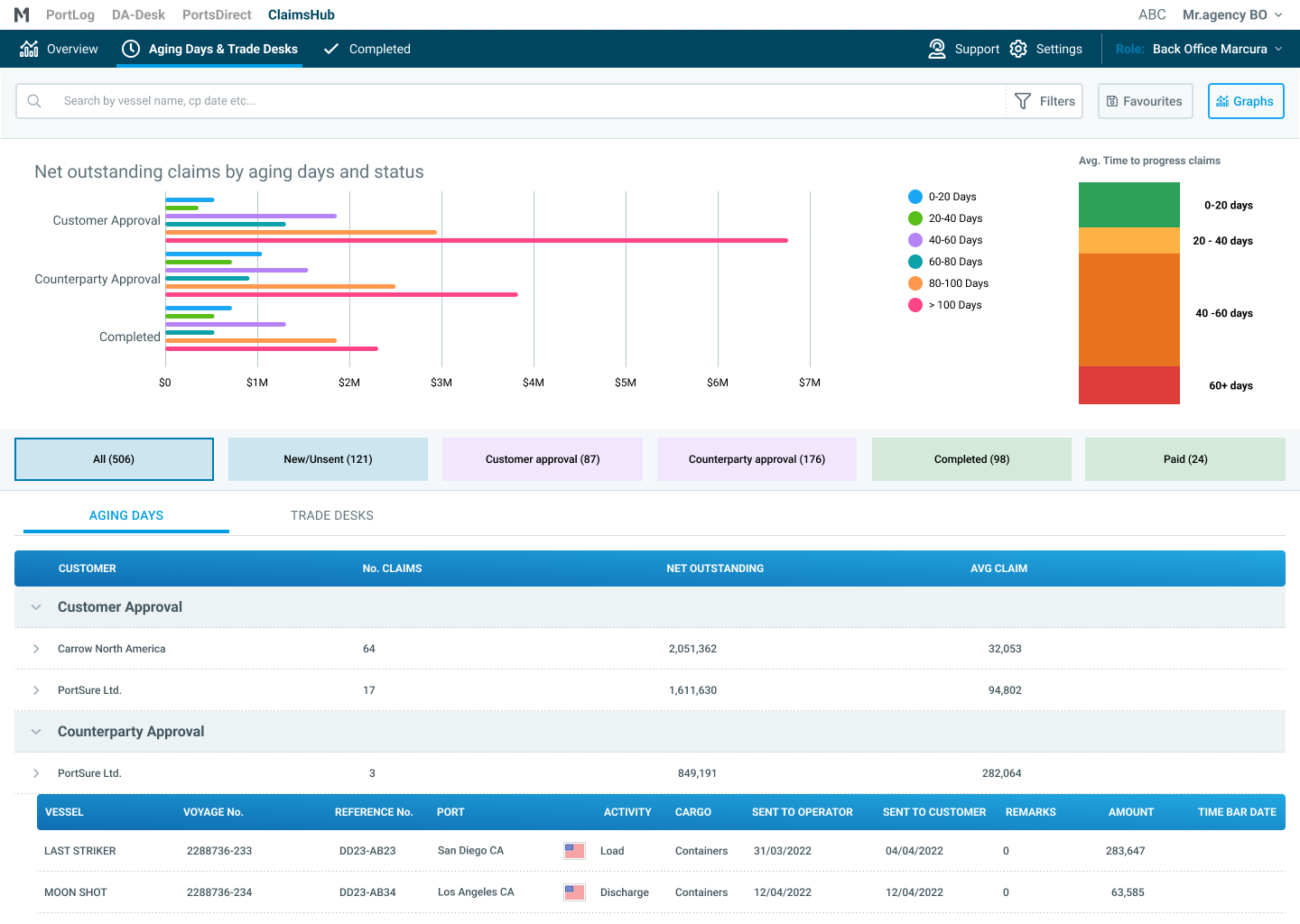

Data and analysis for all, financial dashboard:

There’s an audit trail, you can see exactly what’s going on with all your counterparties and there’s a financial dashboard so you can see how your claims are evolving and how your outstandings are going down and they’re being paid faster or you can feed that data into your finance platform.

Why the .AI in ClaimsHub.ai?

Running a laytime platform is tricky.

We use a combination of human talent, automation and AI power to analyse your claims quickly and accurately.

To bring all the data, analysis and documents together at the right place and at the right time takes AI and machine learning to get right.

ClaimsHub key benefits

We’ll take away your headaches but leave you in control.

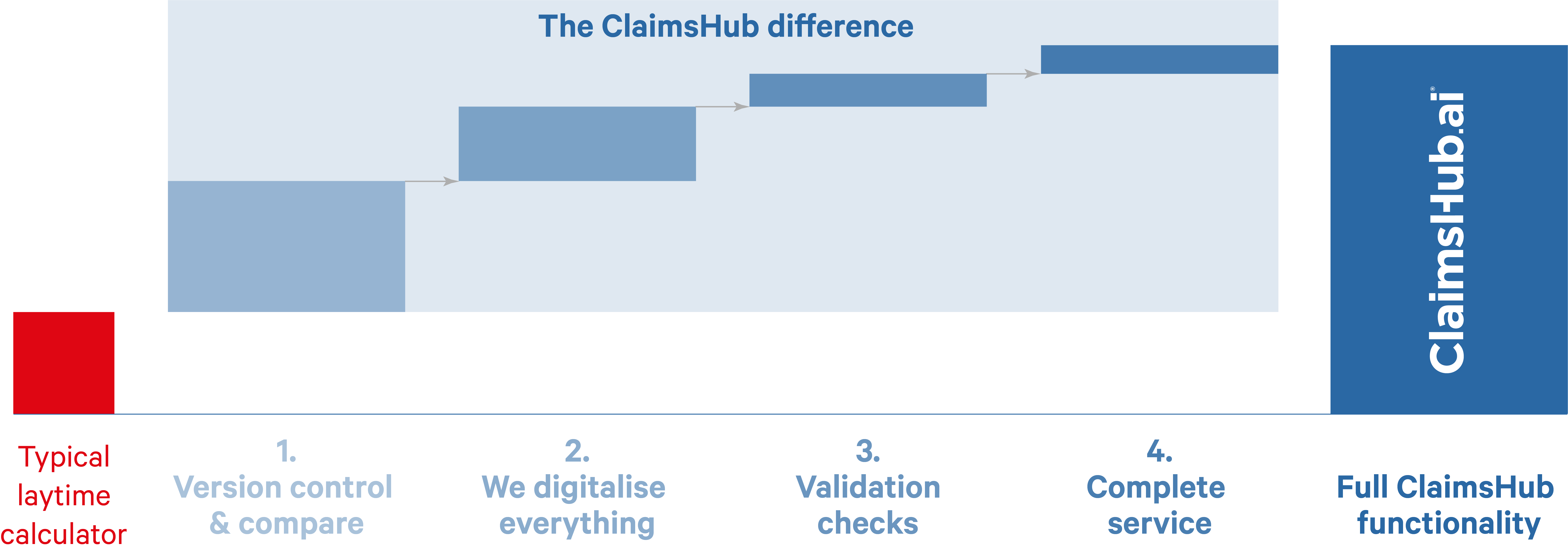

4 ways ClaimsHub is different and unique

ClaimsHub is not another laytime calculator.

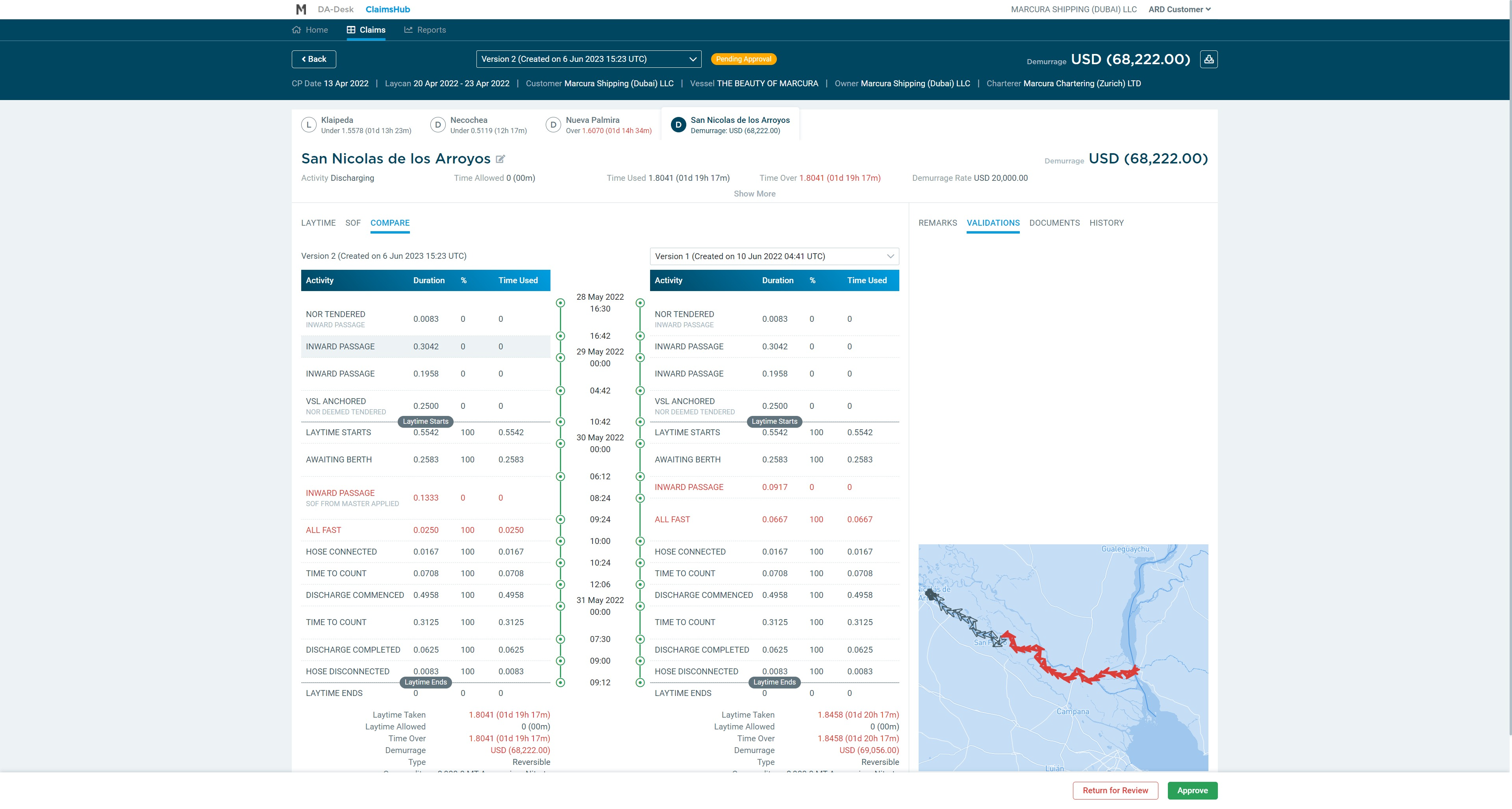

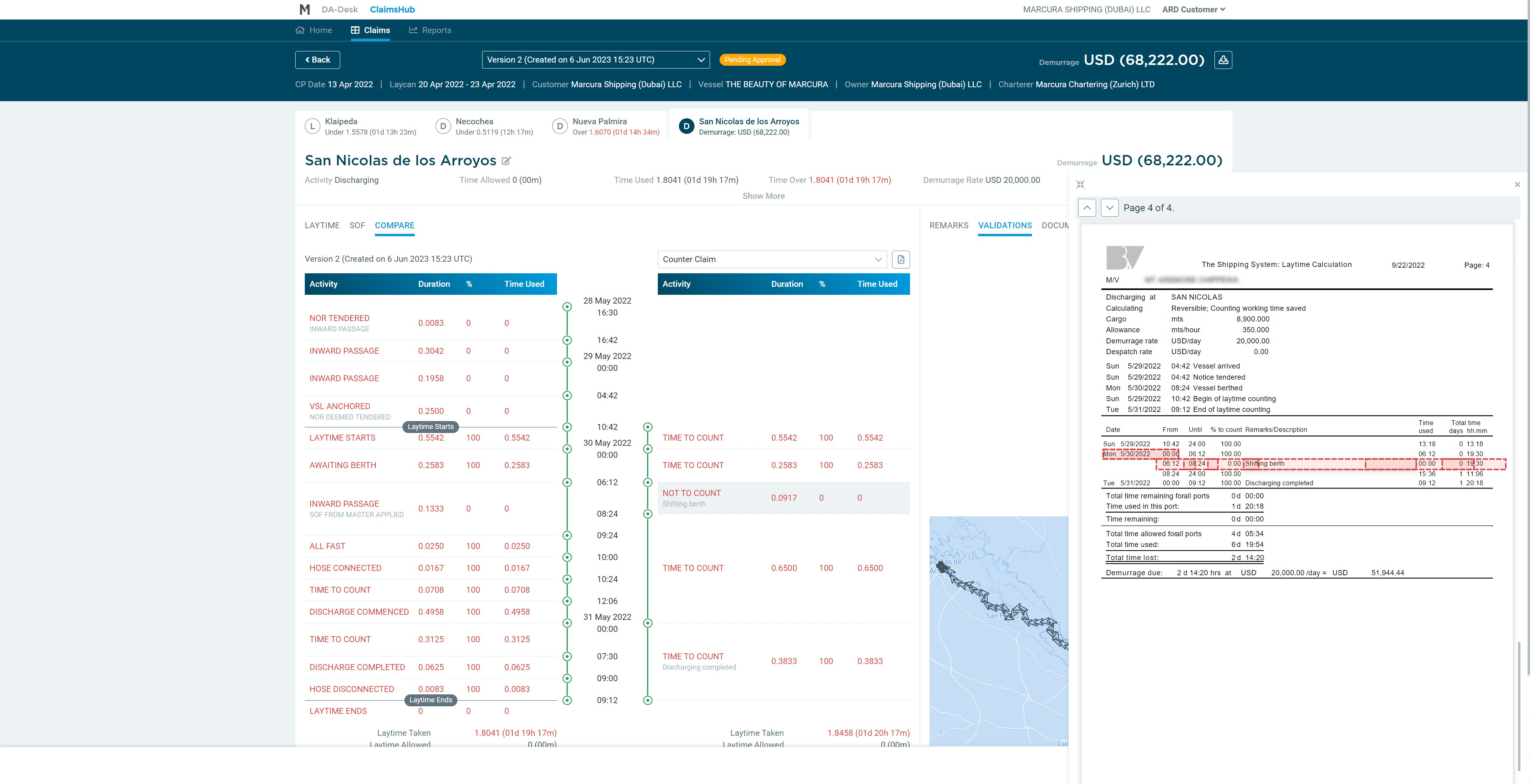

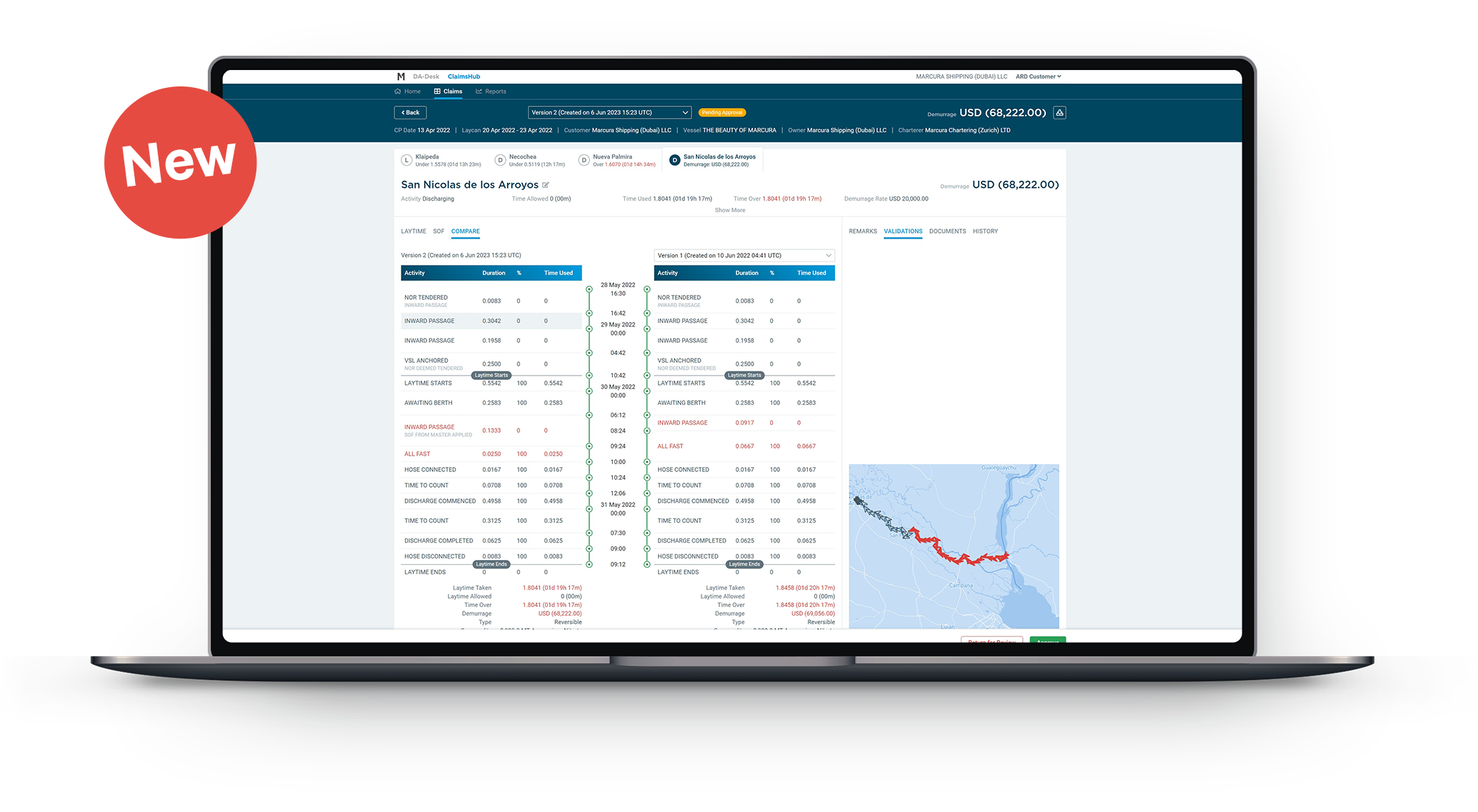

Version control & compare + variance highlighting

We all know agreement of demurrage claims can take a while.

When your claim is returned by your counterparty, you want to be able to easily find your latest version….AND see what’s changed.

ClaimsHub includes a killer feature: the ability to compare any 2 versions during the entire life of the claim, and highlight (in a standard format) what’s changed.

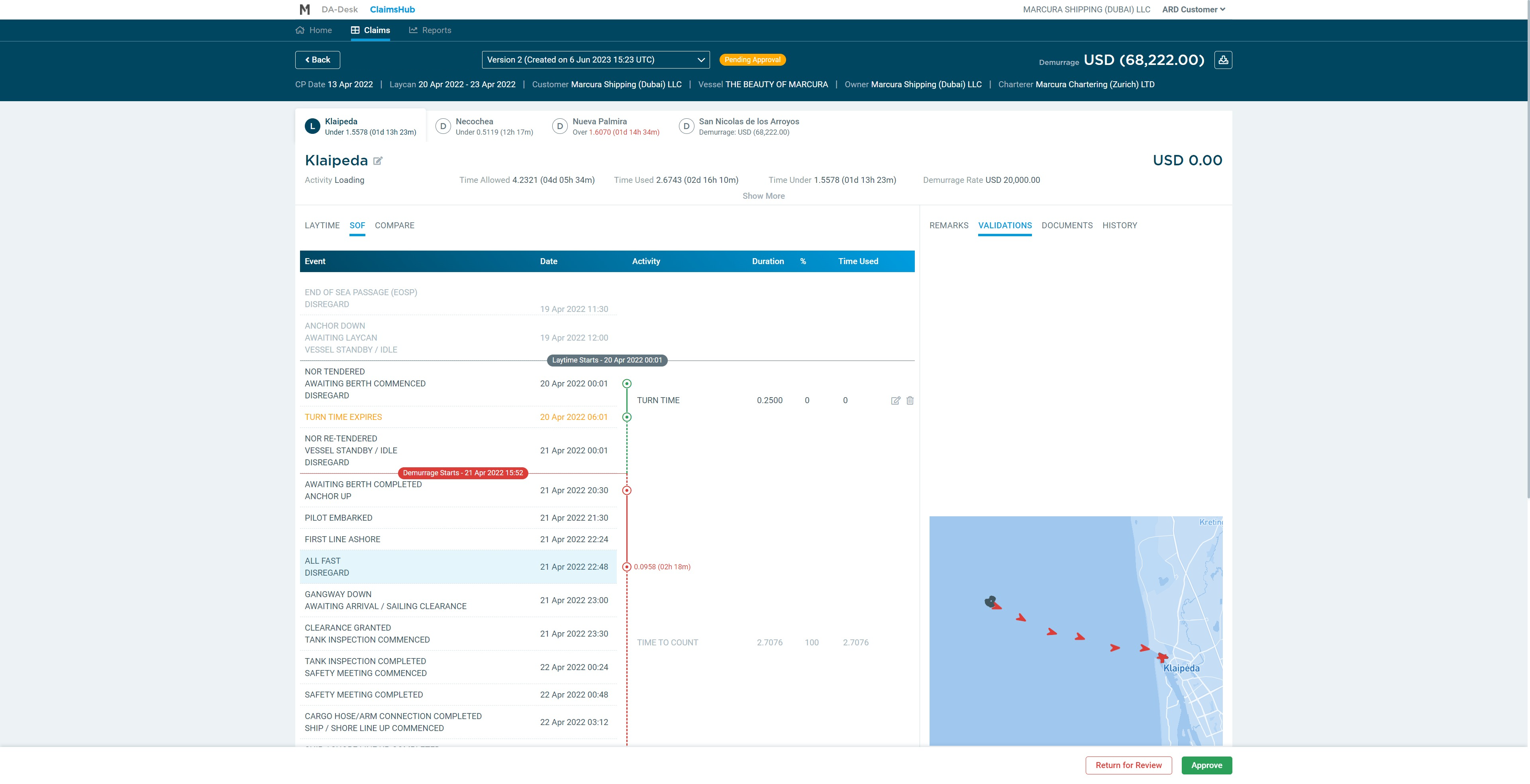

We digitalise everything

Your CPs, your SoFs, other relevant documents, counterparty claims.

So what?

Well, it means fewer errors, and claims which are easy:

- to find

- to read

- for you to review.

Validation checks

We have a series of validation engines which check your claims.

These validations are powered by automation, AI and human specialists.

So what?

This produces quicker, more accurate claims for you to sign off.

It’s a service; not just a platform

We do all the work and deliver to you the claims for your review.

We do the digitisation, checking the data is complete and validated, and the analysis.

We check and ensure each document has all the key data points completed.

If you want us to collect all your relevant laytime original documents from your counterparties, we’ll do it as part of the service.

And, of course, Marcura is well known for its excellent customer service.

Customer views

Here’s what our customers have to say about ClaimsHub.

Comments are from a survey which guaranteed anonymity.

ClaimsHub FAQs

How do you ensure the confidentiality of my data?

Ensuring confidentiality is critical to us at Marcura / ClaimsHub.

We have over 20 years of experience handling and processing confidential documents and data from all our 650+ customers.

We have very strictly controlled tools, processes and technologies in place to ensure this happens.

ClaimsHub’s owner, the Marcura group is a privately owned, independent company.

What is your “consultative approach”?

We are not a “plug and play” solution; we take a highly consultative approach with our customers to ensure that:

- processes are optimised

- risk is managed

- expectations are aligned

Why do we do this? We do this to ensure that we engage with your team to achieve the best possible outcome for your company.

Why are ClaimsHub & Marcura perfectly placed to solve the demurrage issue?

The ClaimsHub platform has its own team but is owned by, and so draws on the experience of, the Marcura group.

To trust someone else to work on your laytime claims, you’ll need them to have ide expertise in dealing with laytime, whciuh we have in our pre-cursor solution to ClaimsHub, called Laytime-Desk.

As it’s a platform bringing standardisation and digitalisation to laytime, you also want to know your provider has experience here.

The current lack of standardisation in laytime is similar to the situation 20 years ago with DAs.

Operators and agents also worked according to different standards and there were a lot of issues in poorly matching processes.

We have solved that to a large degree with DA-Desk and based on our experience, we have studied very carefully how we can help the industry enable a much more streamlined claims process where everybody wins.

Finally, Marcura:

- has strict data security and confidentiality controls and safeguards, including ISO certifications

- is an independent company you can trust with your data.

Marcura has over 20 years of experience of working with maritime data, digitalisation and automation, for our customers worldwide.

Marcura facts and figures

650+

Customers

60-strong

Compliance team

$12bn

Payments made per year

800+

Global team members

2001

Established